So, you finally traded in your gas-guzzler for a sleek Tesla or a lightning-fast Rivian. You’re feeling great about saving $150 a month on gas—until you open your first insurance bill in Miami.

If you’re moving from a state like Ohio to Florida, that “green” savings can vanish in a heartbeat. In 2026, the data is clear: Florida EV owners are paying a “Sunshine Tax” that is roughly 40% to 110% higher than their Midwestern counterparts.

Let’s get real about why your zip code is more important than your driving record when it comes to EV premiums.

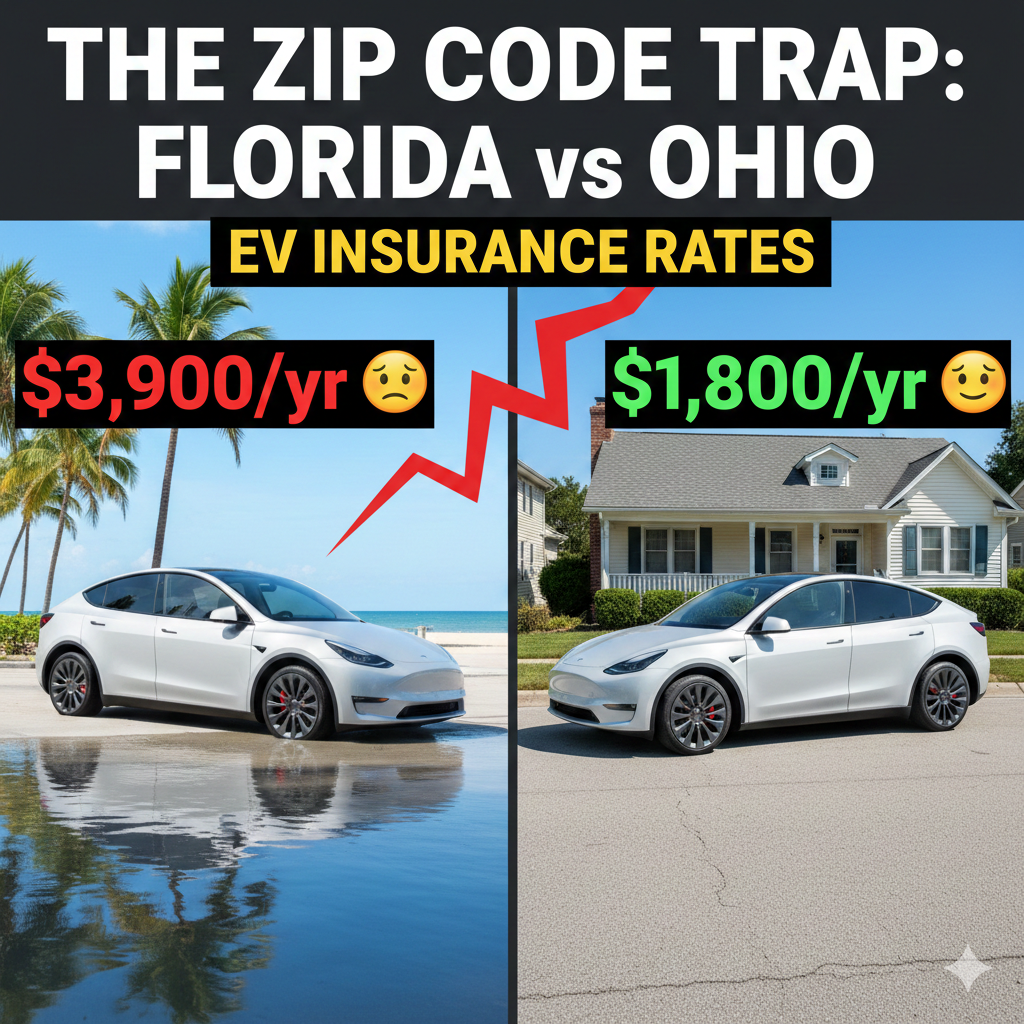

The Reality Check: 2026 Price Comparison

I’ve seen dozens of drivers make this move. Here is what the actual annual hit looks like for a standard Tesla Model Y (the most insured EV in the US):

| Location | Annual Premium (Avg) | The “Hidden” Monthly Cost |

| Columbus, OH (Zip 43215) | $1,850 | $154 |

| Miami, FL (Zip 33101) | $3,950 | $329 |

| The Gap | +$2,100 | Equivalent to a car payment! |

Why Florida is an “Insurance Nightmare” for EVs

It’s easy to blame the insurance companies, but the “Why” is a mix of bad luck, bad weather, and bad laws.

1. The “Flood Factor” (A Death Sentence for EVs)

In Ohio, a heavy rainstorm might mean a car wash. In Florida, it’s a total loss.

- Human Perspective: If salt water from a storm surge touches an EV battery pack, the car is effectively a brick. Unlike a gas engine that can sometimes be rebuilt, an EV battery replacement is so expensive that insurance companies simply “total” the car. Since Florida has more flood claims than almost any other state, you pay for that risk every month.

2. The “Lawsuit Capital” of the World

Florida is a No-Fault state, which sounds good on paper but is a disaster for your wallet.

- The Scam: Florida is famous for “staged accidents” and high-stakes litigation. Because of the state’s PIP (Personal Injury Protection) laws, lawyers and medical clinics often inflate costs. Since EVs are already expensive “luxury” assets, they are prime targets for these high-value lawsuits.

3. The “Uninsured” Truth

Imagine doing everything right—having a 100% clean driving record—and then getting hit by someone with no insurance. * In Florida, nearly 20% of drivers are uninsured. * In Ohio, that number is significantly lower. Because EVs are made of aluminum and high-tech sensors, even a small “tap” from an uninsured driver can cost $10,000 to fix. Your insurance company knows this, so they hike your rates to cover the other guy’s mistakes.

The “Ohio Edge”: Why it’s so Cheap?

Ohio is the “Goldilocks” of insurance. The weather is predictable (mostly), the state has a “Tort” system (meaning the person at fault actually pays), and there is massive competition between local insurance carriers. In Ohio, your EV is treated like a car; in Florida, it’s treated like a rolling liability.

A Real-Life Story: “I Saved $170/mo by Moving North”

Meet Mark. Mark lived in Fort Lauderdale (Zip 33301) and paid $340/month for his Ford F-150 Lightning. When his job went remote, he moved to Cleveland (Zip 44101). Without changing his car, his driving habits, or his coverage limits, his bill dropped to $145/month.

“It felt like I got a massive raise just by changing my mailing address,” Mark says.

3 Insider Tips to Hack Your Rate (Even in Florida)

- Look for “Low-Mileage” Discounts: If you work from home, tell your insurer. If you drive under 5,000 miles a year, you could save 20%.

- The “Garage” Factor: If you can prove your EV is parked in a secured, raised garage (away from flood zones), some premium carriers like Chubb or Cincinnati Insurance might give you a break.

- Tesla Insurance (The Wildcard): If you drive a Tesla, their in-house insurance is often the only way to get “Ohio prices” in Florida—but only if you have a Safety Score of 95+.

Frequently Asked Questions (FAQ)

Why is EV insurance specifically more expensive than gas cars?

It’s the Repairability Index. A fender bender on a Honda Civic is $800. The same hit on a Rivian could require replacing the entire rear quarter panel and recalibrating $3,000 worth of sensors.

Does Florida’s “Sunshine” help my EV battery?

Actually, extreme heat can degrade lithium-ion batteries over a long period, but it’s the humidity and salt air that concern insurers more due to potential corrosion on electrical components.

Is it cheaper to insure a used EV?

Not necessarily. While the car’s value is lower, the cost of parts and labor remains the same. A 5-year-old Tesla costs just as much to fix as a brand-new one.

Will rates go down?

There is hope! Florida’s legislature is currently debating reforms to limit “frivolous lawsuits.” If these pass, we could see a 10-15% dip by late 2026.